As the second-quarter reporting season draws to a close, a survey by shipping consultancy Alphaliner this week showed that the leading large shipping companies are outpacing their peers in terms of earnings growth and fleet capacity.

In addition, the agency noted that a "two-tier market" may be developing between shipowners that focus on contracts and shipowners that use the spot market to boost value.

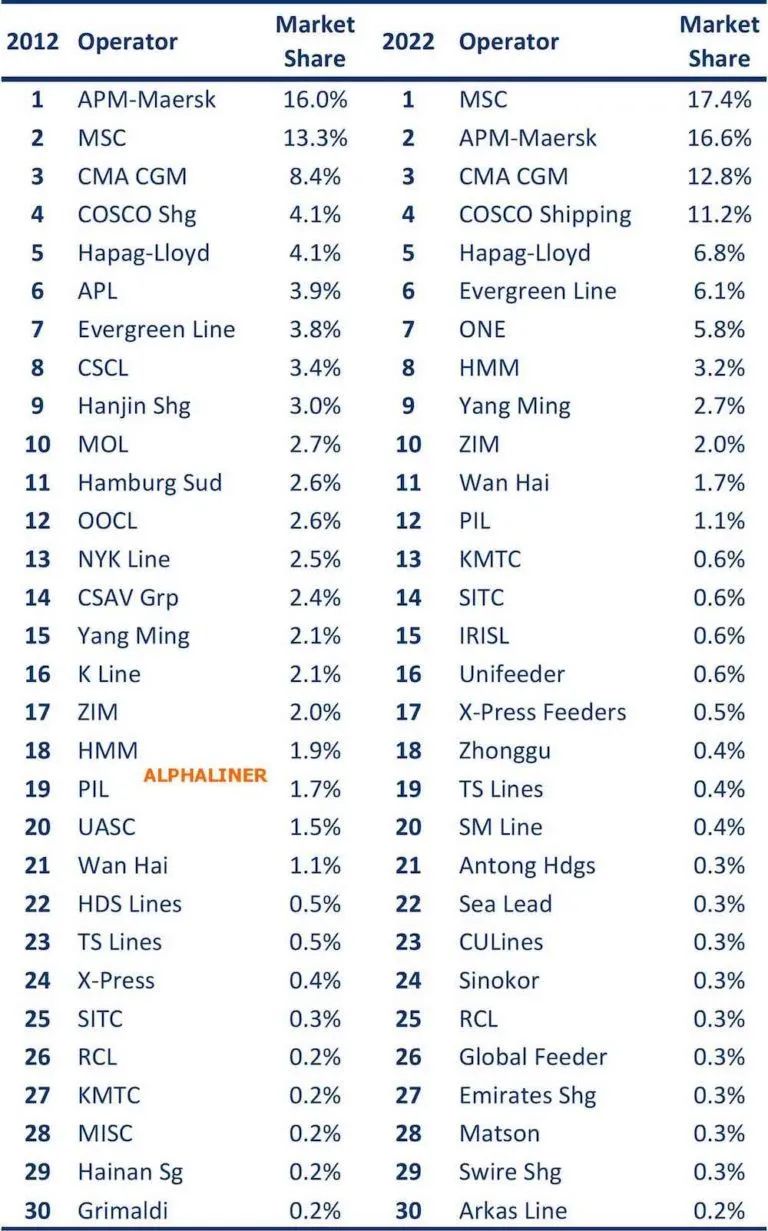

Currently, MSC, the world's number one by capacity, has a total fleet capacity of 4.48 million TEU, while SM Line, ranked 20th, has a total fleet capacity of 93,410TEU, a gap of 4.38 million TEU. In 2017, Maersk ranked first in capacity, with a capacity gap of 3.2 million TEU between it and the 20th ranked shipping company.

The figures show that large shipping companies have increased the size of their fleets as revenues have soared over the past two years. The latest data shows that the top 10 shipping companies have a combined capacity of 21.8 million TEU, while the next 20, ranked 11th to 30th, have a combined capacity of only 2.5 million TEU.

Alphaliner said: "With the widespread consolidation/acquisition of the top ranked shipping companies, it has attracted the attention of politicians and regulators. There is a huge gap between the current leading ship companies and the rest of the industry."

Alphaliner's data also showed that larger shipping companies also experienced higher revenue growth rates during the pandemic. Between 2019 and 2021, the profits of the top 10 shipping companies increased by 1,000% to nearly 6,000%, compared to revenue growth of 100% to 700% for other shipping companies.